Thursday, June 30, 2011

Monday, June 27, 2011

Sunday, June 26, 2011

Second Amendment- Our Rights

I only needed to see this video once to realize it needs promotion. For 159 years this country was not an entitlement republic. It was a nation founded on protection and security. The Roman empire was defeated because it wouldn't let its citizens arm themsleves. I can guarantee you our forefathers knew that fact. Only when Rome could not longer afford its army due to monetary problems did it revoke that law. Today the United States is on the same path as Rome.

Friday, June 24, 2011

Grace Cuozzo's Rants, Half-Truths, and Distortions

When Grace Cuzzo announced she was seeking the office of Mayor of Hazleton she cited her tenure on the Hazleton Housing Authority as proof of some government experience. SOP has secured many documents saved from her term as a board commissioner. The information provides a very disturbing pattern of lack of cooperation, but more importantly, points to a failure of the duty of loyalty in the performance of her duties. This series will explore her term to educate the public on her behavior.

Cuozzo wrote to many state and federal authorities and agnecies claiming to have uncovered improper actions by the board. She questioned experienced and certified professionals without matching their qualifications with legitmate ones of her own. At one point she proclaimed "No I am not in construction but I am not stupid". Her actions were cited in the resignation of the recording secretary for the board in September, 2001. Those observations are just the tip of the iceberg.

Ms. Cuozzo started her tenure on the Hazleton Housing Authority in 1999. According to her Statements of Financial Interests she had no income nor worked during her entire term on the board(we will explore those documents at a later date). She either was a "homemaker" or "none" for occupation.

One of her rants occurred in September, 2001 when she questioned the recommendation of Larry Meiers, A.I.A. for a bid award in Phase III of work performed for the authority. Her statement "Both you and I know a good bid would assume nothing, therefore the bid would include the correct amount needed to reach that R-value, period." Mr. Meier responded that Ms. Cuozzo failed in her analysis to account for the R-value(insulation) existing in the building. "Apparently, you did not understand my statement since we did add the correct amount, unit by unit, to reach the required thickness and R-vlue."

Meiser's response in this episode was two pages long. Item by item he discredited Cuozzo. His frustration spilled over onto the end of his letter.

"Every single day I ask myself how our frim can be the most professional, qualified, technologically advanced and yet competitive firm it can be. This process never stops. Our records shows that we are a highly qualified, professional firm and can compete with any firm in this area and beyond. I resent your implication that we are not.

If you are searching for the perfect firm with perfect human beings, you will not find one.

Any and all correspondence should be directed to the A/E through the Housing Authority. We will reply only to correspondence through the Housing Authority, if so directed.

Imagine the time and energy expended because Ms. Cuozzo distorted facts and felt her "questions" were factual. She called her questions "legitimate concerns". That assessment depends on which side of the court you look from.

It should be noted that Cuozzo received just 512 votes in the Democratic Primary of 2012 for the office of Mayor. Her opponent, Joseph Corradini(there is a strange twist to their relationship) received 365. Write-In for Mayor received 465 votes meaning Cuozzo didn't even capture 39% of the total vote. Her opponent, now Mayor Joseph Yannuzzi received over 54% of the Republican vote at 765.

Next issue will deal with a censure by the Board of Commissioners against Grace Cuozzo signed in October, 2001.

Cuozzo wrote to many state and federal authorities and agnecies claiming to have uncovered improper actions by the board. She questioned experienced and certified professionals without matching their qualifications with legitmate ones of her own. At one point she proclaimed "No I am not in construction but I am not stupid". Her actions were cited in the resignation of the recording secretary for the board in September, 2001. Those observations are just the tip of the iceberg.

Ms. Cuozzo started her tenure on the Hazleton Housing Authority in 1999. According to her Statements of Financial Interests she had no income nor worked during her entire term on the board(we will explore those documents at a later date). She either was a "homemaker" or "none" for occupation.

One of her rants occurred in September, 2001 when she questioned the recommendation of Larry Meiers, A.I.A. for a bid award in Phase III of work performed for the authority. Her statement "Both you and I know a good bid would assume nothing, therefore the bid would include the correct amount needed to reach that R-value, period." Mr. Meier responded that Ms. Cuozzo failed in her analysis to account for the R-value(insulation) existing in the building. "Apparently, you did not understand my statement since we did add the correct amount, unit by unit, to reach the required thickness and R-vlue."

Meiser's response in this episode was two pages long. Item by item he discredited Cuozzo. His frustration spilled over onto the end of his letter.

"Every single day I ask myself how our frim can be the most professional, qualified, technologically advanced and yet competitive firm it can be. This process never stops. Our records shows that we are a highly qualified, professional firm and can compete with any firm in this area and beyond. I resent your implication that we are not.

If you are searching for the perfect firm with perfect human beings, you will not find one.

Any and all correspondence should be directed to the A/E through the Housing Authority. We will reply only to correspondence through the Housing Authority, if so directed.

Imagine the time and energy expended because Ms. Cuozzo distorted facts and felt her "questions" were factual. She called her questions "legitimate concerns". That assessment depends on which side of the court you look from.

It should be noted that Cuozzo received just 512 votes in the Democratic Primary of 2012 for the office of Mayor. Her opponent, Joseph Corradini(there is a strange twist to their relationship) received 365. Write-In for Mayor received 465 votes meaning Cuozzo didn't even capture 39% of the total vote. Her opponent, now Mayor Joseph Yannuzzi received over 54% of the Republican vote at 765.

Next issue will deal with a censure by the Board of Commissioners against Grace Cuozzo signed in October, 2001.

UnOfficial Terms Of AFSCME/COMMONWEALTH Agreement

These terms were posted on a PennLive.com story.

SALARIES & WAGES:

-July 2011 – No Raise;

-Jan 2012 – No Raise or increment (step);

-July 2012 – Raise of 1%;

-Jan 2013 – No Raise or increment;

-Apr 2013 – Increment;

-July 2013 – Raise of ½%;

-Jan 2014 – Raise of ½%;

-Apr 2014 – Increment;

-July 2014 – Raise of 2%;

-Jan 2015 – Increment

Total pay increase for the life of the contract is 10.75%. An increment is 2.25% increase. You can still get a lump sum payment if you are at the top of your grade.

SICK LEAVE:

A decrease from 13 days to 11 days for everyone. You can still accumulate as many sick days as you want and there will be no % reduction for any days you use. As an incentive, if you do not take a sick day during the year you will receive one extra personal day.

PERSONAL DAYS:

Will still have 4 days per year. You can use 2 without prior authorization, the other 2 must be preapproved. This is only if management requires preapproval.

ROLLING FURLOUGHS:

There will be no rolling furloughs for the life of the contract.

ALTERNATE WORK SCHEDULE:

If it works for your office there may be a 4 day week with 3 days off or you can schedule your days to have an extra day off every other week. They are leaving this within the AWS section of the contract to be handled through each individual office through normal chain of command.

HEALTH CARE:

First three years of the contract the contribution rate will remain at 3% of your salary. The fourth year of the contract the contribution rate will be 5%. Get Healthy will remain and the 50% reduction will remain in effect if you participate. This means it will be 1½% when the contribution rate is 3% and, when the rate goes to 5% your contribution rate will only be 2%.

Retirees contribution rate will remain at 3% for the life of the contract. When a retiree turns 65 and goes onto Medicare, the contribution rate will decrease to 1½%.

There will be no change in health benefits. All copays will remain the same except ER visits will increase from $50 to $100 beginninig in 2012. Any increases in copays will not be addressed in the contract itself but changes can be made by the board of trustees of PEBTF if they seem necessary.

DRUG/ALCOHOL TESTING:

There will be no drug or alcohol testing during the life of the contract.

OVERTIME EQUALIZATION:

If an employee is on an O/T list and is called for O/T the following will apply: The employee can refuse the O/T or, when the employee does not answer the call, he/she has 10 minutes to return the call or the next person on the list will be called. The employee will have no right to O/T payment if any of those scenarios are met.

BUMPING RIGHTS:

Full time employees can bump into other full time or part time positions. Part time employees can only bump into other part time positions.

NOTEWORTHY ITEMS:

The was other talk and agreement on FMLA prior to 1992 and a person losing seniority for that. There is a way to get that senority back.

Grievances will remain on the accelerated procedures now set up.

There will be a new committee set up to look at repensioning and salary restructuring if recruitment methods are not working.

Again, unofficial.

SALARIES & WAGES:

-July 2011 – No Raise;

-Jan 2012 – No Raise or increment (step);

-July 2012 – Raise of 1%;

-Jan 2013 – No Raise or increment;

-Apr 2013 – Increment;

-July 2013 – Raise of ½%;

-Jan 2014 – Raise of ½%;

-Apr 2014 – Increment;

-July 2014 – Raise of 2%;

-Jan 2015 – Increment

Total pay increase for the life of the contract is 10.75%. An increment is 2.25% increase. You can still get a lump sum payment if you are at the top of your grade.

SICK LEAVE:

A decrease from 13 days to 11 days for everyone. You can still accumulate as many sick days as you want and there will be no % reduction for any days you use. As an incentive, if you do not take a sick day during the year you will receive one extra personal day.

PERSONAL DAYS:

Will still have 4 days per year. You can use 2 without prior authorization, the other 2 must be preapproved. This is only if management requires preapproval.

ROLLING FURLOUGHS:

There will be no rolling furloughs for the life of the contract.

ALTERNATE WORK SCHEDULE:

If it works for your office there may be a 4 day week with 3 days off or you can schedule your days to have an extra day off every other week. They are leaving this within the AWS section of the contract to be handled through each individual office through normal chain of command.

HEALTH CARE:

First three years of the contract the contribution rate will remain at 3% of your salary. The fourth year of the contract the contribution rate will be 5%. Get Healthy will remain and the 50% reduction will remain in effect if you participate. This means it will be 1½% when the contribution rate is 3% and, when the rate goes to 5% your contribution rate will only be 2%.

Retirees contribution rate will remain at 3% for the life of the contract. When a retiree turns 65 and goes onto Medicare, the contribution rate will decrease to 1½%.

There will be no change in health benefits. All copays will remain the same except ER visits will increase from $50 to $100 beginninig in 2012. Any increases in copays will not be addressed in the contract itself but changes can be made by the board of trustees of PEBTF if they seem necessary.

DRUG/ALCOHOL TESTING:

There will be no drug or alcohol testing during the life of the contract.

OVERTIME EQUALIZATION:

If an employee is on an O/T list and is called for O/T the following will apply: The employee can refuse the O/T or, when the employee does not answer the call, he/she has 10 minutes to return the call or the next person on the list will be called. The employee will have no right to O/T payment if any of those scenarios are met.

BUMPING RIGHTS:

Full time employees can bump into other full time or part time positions. Part time employees can only bump into other part time positions.

NOTEWORTHY ITEMS:

The was other talk and agreement on FMLA prior to 1992 and a person losing seniority for that. There is a way to get that senority back.

Grievances will remain on the accelerated procedures now set up.

There will be a new committee set up to look at repensioning and salary restructuring if recruitment methods are not working.

Again, unofficial.

Senator John Yudichak Leads The Effort On Marcellus Shale Impact

Back in March of this year Senator John Yudichak(D-Luzerne) proposed legislation that would implement a severance tax on the extraction of natural gas in Pennsylvania. He was joined in his bipartisan effort with Senator Ted Erickson (R) and Senator John Blake(D) at the news conference according to PA Environment Daily.

“My goal is to initiate a fair and responsible severance tax in Pennsylvania. This proposal will generate significant revenue for local governments, our clean water infrastructure, and the Growing Greener program,” Sen. Yudichak said. “At the same time, such a moderate tax would allow the industry to continue expanding and creating jobs, as well as generate the economic development activity that Pennsylvania so desperately needs.”

Under Sen. Yudichak’s plan (Senate Bill 905), the severance tax would be gradually implemented based on the gas production of each well:

• A severance tax of 2 percent of the gross value of the natural gas severed at the wellhead; this tax rate would be in place for the first three years of well production;

• When the well has been in production for more than three years, the tax rate would increase to 5 percent;

• The tax rate would readjust back to 2 percent if a well’s rate of production fell below 150 MCF of natural gas per day and above 60 MCF per day;

• Wells that produce less than 60 MCF of natural gas per day are exempt from the tax.

If implemented, the severance tax would go into effect on July 1, 2011.

According to Yudichak, revenue from the severance tax would be distributed to three program areas:

• 33 percent of the revenue generated to the Commonwealth Financing Authority for water supply, wastewater treatment, stormwater and flood control projects;

• 33 percent to the Environmental Stewardship Fund (Growing Greener); and

• 34 percent to local governments in those areas of Pennsylvania that are experiencing the direct effects of natural gas drilling.

Senator Yudichak has been closely monitoring this legislation as it moves along in the Senate process.

Let me be the first one to put this observation out there in public. I met Senator Yudichak during the last election cycle. He is a straight shooter, very intelligent, and well versed on government and issues affecting the public.

His bipartisan approach out of the gate as Senator is worthy of mention. He has worked well with Representative Tarah Toohil and Congressman Lou Barletta, both Republicans. Keep an eye on Yudichak for a stab at the governor's seat one day. If he continues on this path he will be a formidable candidate.

It is also worthy to note the great job Rep. Tarah Toohil and Congressman Lou Barletta are performing in "crossing the aisle" to reach out to everyone they represent. It is a new era in politics for this area, quite refreshing actually.

Thursday, June 23, 2011

Phyllis Mundy Misplaced Lack of Support To Deal With Public Corruption

On Monday, June 13th, Representative Tarah Toohil moved a bill dealing with corrupt public officials to the floor for a vote. Robert Swift, Harrisburg correspondent, wrote this synopsis of the vote on this bill.

The measure, approved 169-32, would set mandatory/minimum terms of sentences for officials found guilty of the existing crime of official corruption and give victims the opportunity for the first time to seek restitution to recover court-related costs. This crime refers to someone using their public office to infringe on an individual's personal or property rights.

In an unacceptable position from an elected public official from Luzerne County, Rep. Phyllis Mundy voted NO against the bill.

Rep. Phyllis Mundy, D-120, Kingston, called the bill an example of "misplaced priorities" given corrections cost issues. She said the two ex-judges are receiving federal sentences of far greater severity than what the bill provides.

"This bill is really not about Luzerne County even though it purports to be," she added.

Ms. Mundy was joined by several other Democratic lawmakers who said the legislation would add to state corrections costs at a time when Pennsylvania contracted with other state to house convicts in a cost-savings move.

Evidently Rep. Phyllis Mundy is not paying attention to the sentencing of 30 officials snagged in her CORRUPT COUNTY.

Doug Richards- 15 months

Allen Bellas- 6 months house arrest

James Height- 5 months

Jeffrey Piazza- 6 months

Frank Pizzella- 2 years probation 5 months house arrest

Joseph Oliveri- 1 year and one day

Ross Scarantino- 13 months

Brian Dunn- 18 months

Circomlution For Dummies writes

Yeah, okay, so 30-some have been charged. And, what, 25 or so have been sentenced?

And what, pray tell, did those sentences amount to other than a gigantic slap on the collective wrists?

Mundy makes the ridiculous claim that sentencing would burden the budget. So what she is really saying is there are that many corrupt officials out there who, if sentenced, would send the budget into a tailspin. Sorry, Ms. Mundy, on this issue you are either misinformed or part of the problem.

With 169-32 passage, obviously Rep. Mundy should be held accountable for not supporting legislation to clean up public corruption.

The measure, approved 169-32, would set mandatory/minimum terms of sentences for officials found guilty of the existing crime of official corruption and give victims the opportunity for the first time to seek restitution to recover court-related costs. This crime refers to someone using their public office to infringe on an individual's personal or property rights.

In an unacceptable position from an elected public official from Luzerne County, Rep. Phyllis Mundy voted NO against the bill.

Rep. Phyllis Mundy, D-120, Kingston, called the bill an example of "misplaced priorities" given corrections cost issues. She said the two ex-judges are receiving federal sentences of far greater severity than what the bill provides.

"This bill is really not about Luzerne County even though it purports to be," she added.

Ms. Mundy was joined by several other Democratic lawmakers who said the legislation would add to state corrections costs at a time when Pennsylvania contracted with other state to house convicts in a cost-savings move.

Evidently Rep. Phyllis Mundy is not paying attention to the sentencing of 30 officials snagged in her CORRUPT COUNTY.

Doug Richards- 15 months

Allen Bellas- 6 months house arrest

James Height- 5 months

Jeffrey Piazza- 6 months

Frank Pizzella- 2 years probation 5 months house arrest

Joseph Oliveri- 1 year and one day

Ross Scarantino- 13 months

Brian Dunn- 18 months

Circomlution For Dummies writes

Yeah, okay, so 30-some have been charged. And, what, 25 or so have been sentenced?

And what, pray tell, did those sentences amount to other than a gigantic slap on the collective wrists?

Mundy makes the ridiculous claim that sentencing would burden the budget. So what she is really saying is there are that many corrupt officials out there who, if sentenced, would send the budget into a tailspin. Sorry, Ms. Mundy, on this issue you are either misinformed or part of the problem.

With 169-32 passage, obviously Rep. Mundy should be held accountable for not supporting legislation to clean up public corruption.

Monday, June 13, 2011

Dee Deakos- Self Advocate Part 2

At the Hazleton City Council meeting November 3, 2010 the council members passed a budget for spending federal block-grant dollars. Veteran Times Leader reporter Steve Mocarsky penned an article on November 5th about that meeting.

HAZLETON – City Council on Wednesday approved a new budget for spending federal block-grant dollars and asked the city administrator to look into the replacement of burnt-out street lights.

City officials expect to receive $1 million in community development block grant money from the federal government and $41,000 in program income.

The article lists the use of the grant money.

• $50,000 for Housing Rehabilitation Forgiveness Loans for single-family, owner-occupied homes.

• $60,000 for acquisition and rehabilitation of vacant properties for single-family homes to be sold to low- or moderate-income buyers or used as rental properties and managed by Housing Development Corp.

Dee Deakos made this comment during the meeting.

During public comment before a vote, rental property owner and Hazleton Taxpayer Association member Dee Deakos told council that limiting the acquisition/rehabilitation funds for rental properties to Housing Development Corp. was discriminatory to other rental property owners in the city.

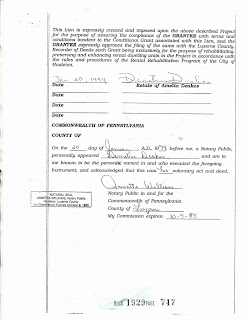

Ms. Deakos has a habit of lobbying for money so that she may gain financially from its availability. Back in 1994 Ms. Deakos was the recipient of $7,020.00 "for the rehabilitation, preservation, and enhancement" of the property she presently resides in downtown Hazleton. Below are images of the documents filed for that money. As you can see the City of Hazleton held the mortgage/lein on her property.

Ms. Deakos evidently didn't find it discriminatory when she was the benefactor of a forgiveness loan in the amount of $7,020.00. On December 11, 2007 the City of Hazleton filed a mortgage satisfaction piece forgiving the entire amount according to the terms of the original mortgage/lein. The source of these funds came from the U.S. Housing and Urban Development agency, commonly known as HUD.

Does she feel this action by Council would be discriminatory because she would not qualify for the funds? How does a "taxpayer advocate" essentially lobby the very government she claims to be watching for money? She could personally benefit but escapes the claim of "quasi conflict of interest. Self advocating is not taxpayer advocating.

Taxpayers should scrutinize Ms. Deakos's actions more closely to see who's interest she really has in mind. How many citizens of Hazleton would like $7,020.00 of free money to fix up their own residences?

She complained to HUD about a potential conflict of interest against then councilman Joe Yannuzzi over his involvement with Crossroads Computer hired by the City of Hazleton.

Yannuzzi accused Deakos of filing a complaint with HUD so that her computer firm would get business from the city.

She denied the claim, although a valid one. The fact that she is in the computer business gives the same appearance of a conflict of interest that mirrors the essence of her complaint about Yannuzzi to HUD.

Evidently what's good for the goose isn't good for the gander.

HAZLETON – City Council on Wednesday approved a new budget for spending federal block-grant dollars and asked the city administrator to look into the replacement of burnt-out street lights.

City officials expect to receive $1 million in community development block grant money from the federal government and $41,000 in program income.

The article lists the use of the grant money.

• $50,000 for Housing Rehabilitation Forgiveness Loans for single-family, owner-occupied homes.

• $60,000 for acquisition and rehabilitation of vacant properties for single-family homes to be sold to low- or moderate-income buyers or used as rental properties and managed by Housing Development Corp.

Dee Deakos made this comment during the meeting.

During public comment before a vote, rental property owner and Hazleton Taxpayer Association member Dee Deakos told council that limiting the acquisition/rehabilitation funds for rental properties to Housing Development Corp. was discriminatory to other rental property owners in the city.

Ms. Deakos has a habit of lobbying for money so that she may gain financially from its availability. Back in 1994 Ms. Deakos was the recipient of $7,020.00 "for the rehabilitation, preservation, and enhancement" of the property she presently resides in downtown Hazleton. Below are images of the documents filed for that money. As you can see the City of Hazleton held the mortgage/lein on her property.

Ms. Deakos evidently didn't find it discriminatory when she was the benefactor of a forgiveness loan in the amount of $7,020.00. On December 11, 2007 the City of Hazleton filed a mortgage satisfaction piece forgiving the entire amount according to the terms of the original mortgage/lein. The source of these funds came from the U.S. Housing and Urban Development agency, commonly known as HUD.

Does she feel this action by Council would be discriminatory because she would not qualify for the funds? How does a "taxpayer advocate" essentially lobby the very government she claims to be watching for money? She could personally benefit but escapes the claim of "quasi conflict of interest. Self advocating is not taxpayer advocating.

Taxpayers should scrutinize Ms. Deakos's actions more closely to see who's interest she really has in mind. How many citizens of Hazleton would like $7,020.00 of free money to fix up their own residences?

She complained to HUD about a potential conflict of interest against then councilman Joe Yannuzzi over his involvement with Crossroads Computer hired by the City of Hazleton.

Yannuzzi accused Deakos of filing a complaint with HUD so that her computer firm would get business from the city.

She denied the claim, although a valid one. The fact that she is in the computer business gives the same appearance of a conflict of interest that mirrors the essence of her complaint about Yannuzzi to HUD.

Evidently what's good for the goose isn't good for the gander.

Sunday, June 12, 2011

Dee Deakos- The Taxpayers' Demagogue Part 1

The roll of honor consists of the names who have squared their conduct by ideals of duty- Woodrow Wilson

Men walk among their peers who judge them by their actions, not their words. Sometimes the actions are so loud the public can't hear what one is saying.

In the case of Dee Deakos it is time that the public examines her record to see if she justly deserves the title "taxpayer advocate".

Recently Ms. Deakos attacked Hazleton City Authority Board Member John Keegan over his abstention from voting on Resolution 26 of May 24, 2011 where money was being transferred from PNC Bank to Landmark Bank. She tried to insuate with her questioning that the reason Mr. Keegan was abstaining was because he was hiding some financial gain. Anyone with common sense would know that if there was a possible financial gain Mr. Keegan would have to abstain and that would be a legal action. How does one abstain to "hide" financial gain? An abstention is the duty of the board member in that case.

Mr. Keegan refused to answer her question because his potential conflict of interest has been published in the Standard Speaker no less than three times. December 24, 2010, December 26, 2010, and July 26, 2010 The last article is the one that caused the confusion with Deakos since it incorrectly mentions that Mr. Keegan was a member of the Board of Directors of the Bank. However, as one can see the subsequent articles adequately cleared up that mistake.

Properly, Mr. Keegan and the board's solicitor, Attorney Peter O'Donnell told Ms. Deakos that she could avail herself of the Open Records provisions and make a Right to Know request to see the documents that would answer her question.

However, Ms. Deakos was not satisfied with trying to follow the law. She approached the board with the matter again at the next meeting. Her false allegations made the press in this article that appeared in the Hazleton Standard Speaker.

Ms. Deakos is summarized asking making this statement by reporter Sam Galski.

Deakos, however, asked why Keegan couldn't provide a reason publicly if he wasn't realizing any financial gain. It is published in the newspaper no less than three times yet she said he didn't state his reason publically? Even if Mr. Keegan would have realized a financial gain due to the transaction he abstained which is the proper thing to do.

What the public should ask Ms. Deakos is why she didn't question the other board members who DID vote to secure the loans from the bank. She was told that no less than three banks were approached for the first loan by the HCA manager and CPA. Not one board member was involved in the process. In the case of the second loan even more were given the opportunity to submit a proposal.

The State Ethics Commission concerns itself when a board member uses his or her position for financial gain, NOT when he/she abstains from voting to prevent the conflict from influencing the outcome.

Mr. Keegan told Ms. Deakos his abstention was not for conflict of interest on Resolution 36, therefore, needed no explanation. He also reiterated that every time he felt he had a conflict of interest he followed the law and submitted in writing that he had a conflict.

What Ms. Deakos didn't tell the public was her involvement on prior occassions with the board trying to secure financial gain for herself by soliciting the board for no-bid work. The following observation by reporter Sam Galski was made in This article that appeared on December 9, 2010 in the Standard Speaker.

Audience member Dee Deakos, who offered to merge the city and authority data bases through her firm, Pharmahouse, estimates that the process could take about a month.

That action wouldn't be her last approach to the board. After a board meeting she approached four of the five members of the board to discuss her proposal. By doing so she may have inadvertently caused the board members to face the accusation of an illegal board meeting in violation of the Sunshine Act. Ms. Deakos's actions went unnoticed until now.

The public trust falls prey when the end game is the "booty" to be had.

It is a shame that the Hazleton Taxpayers Association doesn't have a code of ethics that forbids any member from seeking financial gain from boards, commissions, and councils for which it claims to be a "watchdog" over. Of course it remains to be seen if that organization is still meeting on a regular basis.

Part 2 HUD Loans....next installment

Monday, June 6, 2011

Subscribe to:

Posts (Atom)