Three days ago the Pittsburgh Tribune published this article about tax revenue by Thomas Olson.

Pennsylvania tax revenue increases 6.2% over last year

If Pennsylvania's tax collections are any guide, the state's economy is starting to pull out of its recessionary slump, according to experts in Harrisburg.

Overall tax receipts from individuals and companies in Pennsylvania for the fiscal year ended June 30 increased 6.2 percent to nearly $26.5 billion, according to the state Department of Revenue. And taxes of $194 million collected in July and August, the first two months of the current fiscal year, were 5.9 percent ahead of last year's pace.

Today the Times Leader features this article.

Pa. state tax revenues lag expectations by $215M

HARRISBURG, Pa. (AP) — Pennsylvania tax collections are lagging $215 million behind projections after the first three months of the state government's fiscal year.

State Revenue Secretary Daniel Meuser announced Monday the state general fund brought in $5.8 billion from the start of July through the end of September. That's 3.5 percent below expectations.

September collections were $152 million less than had been estimated. Major categories contributing to the shortfall are corporate and personal income taxes.

However, taxes on liquor, cigarettes and table games are running ahead of expectations.

What a beautiful dysfunctional state. Jobs and sales of goods aren't leading us out of the recession. The vices are. They should just legalize prostitution and get it over with.

Maybe this is what they mean by tolling 80!!!

Showing posts with label gambling. Show all posts

Showing posts with label gambling. Show all posts

Monday, October 3, 2011

Wednesday, January 19, 2011

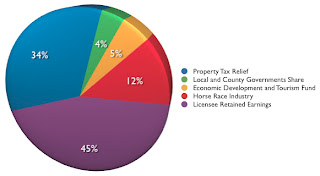

Why Does The Horseracing Industry In Pennsylvania Receive 12% of Gambling Revenues?

When gambling was approved as a means for raising revenue in Pennsylvania the horse racing industry received a huge break. The Pennsylvania Race Horse Development Fund was created under the law to subsidize the breeding program of race horses in Pennsylvania. Read this article that appeared in the Reading Eagle.

Breeding thoroughbreds is, of course, nothing new in Pennsylvania.

But under a state-subsidized breeding program, infused with millions of dollars from Pennsylvania's casino revenues, the Broks get to share in the winnings of the horses they breed.

If any horse they breed finishes in the money - that is, wins, places or shows - at a Pennsylvania track, the Broks get a bonus from a pool of state money called the Pennsylvania Horse Race Development Fund.

So far this year, the Broks have received about $40,000 from the fund.

"Slots have benefited my business tremendously," Glen Brok said. "They've created a great atmosphere for breeding horses in Pennsylvania."

It's no accident that breeders such as the Broks find themselves in the winners circle.

The Pennsylvania Race Horse Development and Gaming Act, the legislation that legalized the state's 14 slots-only casinos, was aimed at reinvigorating the state's sagging horse racing industry.

Purses at Pennsylvania tracks were low, and Pennsylvania-bred horses were being overshadowed by those raised in New York, Kentucky and Florida.

That's all changed because of tax revenue from the slots.

Under the gaming law, 12 percent of gross casino revenues goes to an array of programs that underwrite various aspects of thoroughbred and harness racing in Pennsylvania.

Since the first casino opened in November 2006, slots revenues have pumped $295.3 million into the state's thoroughbred and harness racing industry, according to the Pennsylvania Gaming Control Board.

In 2007, the first full year of operation, the Pennsylvania Race Horse Development Fund received $128.5 million from casino revenues. As a result, purses at Pennsylvania race tracks escalated from $55 million to $144 million in 2007, a nearly 162 percent increase in one year.

Melinda Tucker, director of racetrack gaming, said the 2008 figures will give a clearer picture of the impact of slots on thoroughbred and harness racing in Pennsylvania.

The picture is pretty clear to Rich Miller, owner of Mountain Springs Arena near Shartlesville, where he runs thoroughbred auctions.

He said horse racing in Pennsylvania is doing great.

And, he predicted, it will get even better as the remaining eight casinos begin operations over the next several years.

"Purses are up, and they're going up again in January," Miller said.

"More stallions are coming into Pennsylvania, and more people are getting in the game," he said. "It's getting pretty lucrative now. The value of Pennsylvania-bred horses has about doubled."

That's pretty sickening given the major problems facing Pennsylvanians and Pennsylvania.

Look at this chart.

As a result of their 12% levy the horse racing industry in Pennsylvania has received $829,053,213,26 in revenues since 2006. Here is a link to the information.

Legislators are wondering how to fund our drastic highway repairs so sorely needed...duhhhhh.

Breeding thoroughbreds is, of course, nothing new in Pennsylvania.

But under a state-subsidized breeding program, infused with millions of dollars from Pennsylvania's casino revenues, the Broks get to share in the winnings of the horses they breed.

If any horse they breed finishes in the money - that is, wins, places or shows - at a Pennsylvania track, the Broks get a bonus from a pool of state money called the Pennsylvania Horse Race Development Fund.

So far this year, the Broks have received about $40,000 from the fund.

"Slots have benefited my business tremendously," Glen Brok said. "They've created a great atmosphere for breeding horses in Pennsylvania."

It's no accident that breeders such as the Broks find themselves in the winners circle.

The Pennsylvania Race Horse Development and Gaming Act, the legislation that legalized the state's 14 slots-only casinos, was aimed at reinvigorating the state's sagging horse racing industry.

Purses at Pennsylvania tracks were low, and Pennsylvania-bred horses were being overshadowed by those raised in New York, Kentucky and Florida.

That's all changed because of tax revenue from the slots.

Under the gaming law, 12 percent of gross casino revenues goes to an array of programs that underwrite various aspects of thoroughbred and harness racing in Pennsylvania.

Since the first casino opened in November 2006, slots revenues have pumped $295.3 million into the state's thoroughbred and harness racing industry, according to the Pennsylvania Gaming Control Board.

In 2007, the first full year of operation, the Pennsylvania Race Horse Development Fund received $128.5 million from casino revenues. As a result, purses at Pennsylvania race tracks escalated from $55 million to $144 million in 2007, a nearly 162 percent increase in one year.

Melinda Tucker, director of racetrack gaming, said the 2008 figures will give a clearer picture of the impact of slots on thoroughbred and harness racing in Pennsylvania.

The picture is pretty clear to Rich Miller, owner of Mountain Springs Arena near Shartlesville, where he runs thoroughbred auctions.

He said horse racing in Pennsylvania is doing great.

And, he predicted, it will get even better as the remaining eight casinos begin operations over the next several years.

"Purses are up, and they're going up again in January," Miller said.

"More stallions are coming into Pennsylvania, and more people are getting in the game," he said. "It's getting pretty lucrative now. The value of Pennsylvania-bred horses has about doubled."

That's pretty sickening given the major problems facing Pennsylvanians and Pennsylvania.

Look at this chart.

As a result of their 12% levy the horse racing industry in Pennsylvania has received $829,053,213,26 in revenues since 2006. Here is a link to the information.

Legislators are wondering how to fund our drastic highway repairs so sorely needed...duhhhhh.

Monday, March 30, 2009

Where's Our Property Tax Relief Mr. Eachus?

According to Brad Bumsted over at the Pittsburgh Tribune-Review House Majority Leader Todd Eachus raised the question on whether AG Corbett should resign if he decides about a run for governor.

In remarks during a Pennsylvania Press Club luncheon, Eachus questioned whether Pennsylvania taxpayers could get their money's worth if Corbett faced the demands of a statewide campaign for governor.

A Classic Game of Wag The Dog. Let's hit back with a little sarcasim. So Todd, how much are the taxpayers getting for their money over the actions that led to Bonusgate? How much do they get every time you send a mailer to your district? How much did they get when you paid off Mike Veon's campaign debt? How much did they get when the taxpayers financed some of the promotional material for the proposed Cargo Airport outside of Hazleton?

How much property tax relief did they get with the casino money? I'll answer the last one. Zip, nadda, nothing. The account had a balance of $456 million as of March 16, according to the Governor's Office of the Budget. Under state law, the fund must contain at least $570 million for the state to distribute money to reduce homeowners' property taxes. Yet, how much money was distributed to municipalities before property owners??? As of February almost $170 million went to the municipalities according to Mary Collins speaking at the PA Gaming Congress. Why didn't municipalities have to wait but almost 3 times as much money is sitting for distribution to taxpayers and the average Joe has to wait??

How much money did they get in the Beavers for Initiative For Growth with Mike Veon? Let's read what Brad Bumsted at the Pittsburgh Tribune-Review had to say about that.

Attorney General Tom Corbett apparently didn't want to politicize the grand jury presentment against a corrupt Beaver County nonprofit by bringing Gov. Ed Rendell directly into it.

But Rendell's shadow loomed large over the waves of state tax money poured into the Beaver Initiative for Growth, or BIG, the alleged criminal enterprise of the Democrats' former House whip, Mike Veon, a go-to guy for Rendell in the General Assembly.

All of BIG's money came from you -- the taxpayers, Corbett said.

BIG was formed by Veon in 1991 but there wasn't much state money flowing. Veon, however, knew he had hit the jackpot when Rendell, a Democrat, was elected in 2002. Roughly $9.9 million of the $10 million in taxpayer money that BIG would eventually receive came between 2003 and 2006.

Veon allegedly told BIG's former executive director, John Gallo, that "since Edward Rendell had just taken office as governor there were going to be millions of dollars coming to BIG." Gallo cooperated with the grand jury.

At a news conference in Pittsburgh last week, Corbett was asked why BIG all of a sudden got an influx of cash. He told reporters they would have to draw their own conclusions.

I'll do the same with regards to why Corbett became Eachus's target.

In remarks during a Pennsylvania Press Club luncheon, Eachus questioned whether Pennsylvania taxpayers could get their money's worth if Corbett faced the demands of a statewide campaign for governor.

A Classic Game of Wag The Dog. Let's hit back with a little sarcasim. So Todd, how much are the taxpayers getting for their money over the actions that led to Bonusgate? How much do they get every time you send a mailer to your district? How much did they get when you paid off Mike Veon's campaign debt? How much did they get when the taxpayers financed some of the promotional material for the proposed Cargo Airport outside of Hazleton?

How much property tax relief did they get with the casino money? I'll answer the last one. Zip, nadda, nothing. The account had a balance of $456 million as of March 16, according to the Governor's Office of the Budget. Under state law, the fund must contain at least $570 million for the state to distribute money to reduce homeowners' property taxes. Yet, how much money was distributed to municipalities before property owners??? As of February almost $170 million went to the municipalities according to Mary Collins speaking at the PA Gaming Congress. Why didn't municipalities have to wait but almost 3 times as much money is sitting for distribution to taxpayers and the average Joe has to wait??

How much money did they get in the Beavers for Initiative For Growth with Mike Veon? Let's read what Brad Bumsted at the Pittsburgh Tribune-Review had to say about that.

Attorney General Tom Corbett apparently didn't want to politicize the grand jury presentment against a corrupt Beaver County nonprofit by bringing Gov. Ed Rendell directly into it.

But Rendell's shadow loomed large over the waves of state tax money poured into the Beaver Initiative for Growth, or BIG, the alleged criminal enterprise of the Democrats' former House whip, Mike Veon, a go-to guy for Rendell in the General Assembly.

All of BIG's money came from you -- the taxpayers, Corbett said.

BIG was formed by Veon in 1991 but there wasn't much state money flowing. Veon, however, knew he had hit the jackpot when Rendell, a Democrat, was elected in 2002. Roughly $9.9 million of the $10 million in taxpayer money that BIG would eventually receive came between 2003 and 2006.

Veon allegedly told BIG's former executive director, John Gallo, that "since Edward Rendell had just taken office as governor there were going to be millions of dollars coming to BIG." Gallo cooperated with the grand jury.

At a news conference in Pittsburgh last week, Corbett was asked why BIG all of a sudden got an influx of cash. He told reporters they would have to draw their own conclusions.

I'll do the same with regards to why Corbett became Eachus's target.

Subscribe to:

Posts (Atom)